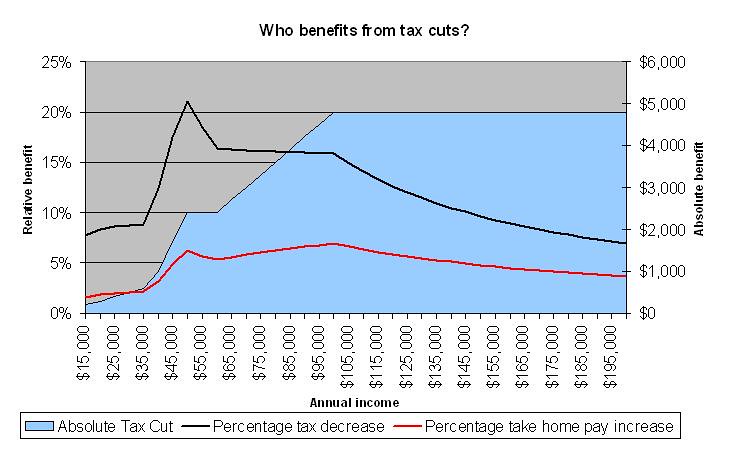

Who benefits from National's tax cut package? In the coments to Anita's post on tax cuts and social (in)equality, Genius made the astounding claim that National's tax cuts "disproportionatly benefit the poor" by

[giving] quite a high % tax cut to low income earners and a negligible one to very high income earners 9and a continum inbetween).

Anita has done the numbers on this, and even a cursory look at them shows that this is not the case, no matter which way you look at it:

Considering the relative decrease in tax, someone has to earn over $165,000 to get less benefit from National's tax cuts than someone earning $35,000, and over $180,000 to do worse than someone on $15,000. In terms of the relative change in take-home pay, the difference is even more stark: someone has to earn $335,000 to do worse than someone on $35,000, or $475,000 to do worse than someone earning $15,000. And of course in absolute terms, those on higher incomes win out hands down.

National's tax cuts do not disproportionately benefit the poor. Instead, the disproportionately benefit exactly the people you'd expect: National's rich backers.

3 comments:

" And of course in absolute terms, those on higher ncomes win out hands down."

Absolutely. Then share that lower tax cut porportionally amongst family members.

Posted by Anonymous : 9/01/2005 04:54:00 PM

OK - you are half right (about it benefiting the rich) - it disproportionatly benefit the middle incomes (middle to upper middle incomes). Should have done the maths first - I admit.

Also hidden in that is that national say they wont index (the reason for the way the benefit changes) but I wont argue that point.

Having said that your graph now has the relevant information - very good!

My point still stands that the take home pay approach you continue to use is an inferior approach.

Posted by Genius : 9/01/2005 07:28:00 PM

The tax cuts benefit best those who earn over $50k. That's about 16% of New Zealanders. That's the group who would get the highest absolute tax cut as well as the highest relative tax cut.

Treasury's predicted figures for the year ending June 2006 state that only 16% of adult NZers will earn over $50,000.

I find it hard to use the words "middle incomes" for the incomes of the top 16% of NZ.

54% of New Zealanders will earn $20,000 or less, getting a tax cut of no more than $330 a year (a percentage tax reduction of ~9%) and many will get nothing.

Every way I cut the figures the disproportionate benefit is for the richest, and the least benefit is for the poorest.

Posted by Anita : 9/01/2005 09:00:00 PM

Post a Comment

(Anonymous comments are enabled).